Etf expense ratio calculator

Total cost of ETF 20766 USD. SBI Gold ETF - Check out the ETF fund overview NAV returns portfolio performance etc.

Expense Ratio Definition Impact On Etf Mutual Fund Returns

While the ETF expense ratio is the same in each case the cost for mutual funds generally is higher.

. Retirement plan income calculator. Effective investment return 1349. The expense ratio above has a contractual waiver ending 63023.

Standard Poors compiles maintains and calculates the Index which is composed of 50 securities traded on the SP 500 Index that. Visit SBI Mutual Fund to invest in SBI Gold ETF Fund. The main cost of investing in a mutual fund is captured in the funds Management Expense Ratio or MER.

The Invesco SP 500 High Dividend Low Volatility ETF Fund is based on the SP 500 Low Volatility High Dividend Index Index. View the latest ETF prices and news for better ETF investing. An expense ratio is an annual fee charged to investors who own mutual funds and exchange-traded funds ETFs.

For example a Nifty 50 ETF tracks the composition of the Nifty 50 Index. In addition the very low 006 expense ratio keeps more of your money at work in the market. The ProShares Short Bitcoin Strategy ETF BITI provides an opportunity to profit when the daily price of bitcoin declines.

Its been more volatile but has also had a higher long-term return and return per unit of risk. When you buy a Nifty ETF you are getting exposure to the 50 stocks that form the Index. It is clear to see that the compound interest effect over time of the Effective investment return can do.

The Fund will invest at least 90 of its total assets in common stocks that comprise the Index. Net Expense Ratio 044. And like all things that offer value theres a cost associated with those benefits.

For information about this ETFs fees please see above. Expense ratio does not include brokerage commissions and related fees paid by the fund. VIG Chart by TradingView All data is sourced from Morningstar current as of July 12 2022.

A fund with an expense ratio of 110 each year costs 0011 of the total assets you have in the fund. And by using our Expense Ratio Calculator we get. DFIV has a lower expense ratio lower annual turnover deeper value orientation and smaller company size.

Similar to the case before the extra information of the advanced section is. And then from Year 1 to Year 5 the DE ratio increases each year until reaching 10x in the final projection. Statement of AC SOA Update Contact Details.

Debt to Equity Ratio DE 120m 175m 07x. CSIM serves as investment advisor to the Schwab ETFs which compensate CSIM out of the applicable operating expense ratios. About ProShares At the forefront of the ETF revolution since 2006.

An ETF Exchange traded fund is a basket of securities that tracks an underlying index. DFAs new International Value ETF DFIV looks likely to unseat iShares MSCI EAFE Value ETF EFV when we do our next update. One has an expense ratio of 08and the other has an expense ratio of 18.

Where Should I Retire. A funds expense ratio is listed as a percentage and represents the percent of your investment that you are charged for investing in the fund. Mutual funds provide important benefits.

A fund that charges 30 basis points charges 30 or 0003 of the amount you have invested per year. As a result the first fund gives returns of 13 annualized while the second fund just gives 12. Schwabs affiliate Charles Schwab Investment Management Inc.

A fund that has an expense ratio of 20 costs the equivalent of 0002 of the amount you have invested. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc. Calculate SIP VIP Returns.

Schwab does not receive payment to promote any particular ETF to its customers. As a conclusion we can say the following. The amount of the fees is disclosed in the prospectus of each ETF.

An Expense Ratio is the fee charged by a fund either a mutual fund or ETF for managing the funds assets. Get latest NAV Returns SIP Returns Performance Ranks Dividends Portfolio CRISIL Rank Expert Recommendations and Comparison with gold stockULIP etc. In Year 1 for instance the DE ratio comes out to 07x.

The expense ratio for certain funds includes a contractual fee waiver that results in a lower net expense ratio for some or all periods shown. High expense ratios can drastically reduce your potential returns over the long term. The debt to equity ratio DE is calculated by dividing the total debt balance by the total equity balance as shown below.

This is a simple.

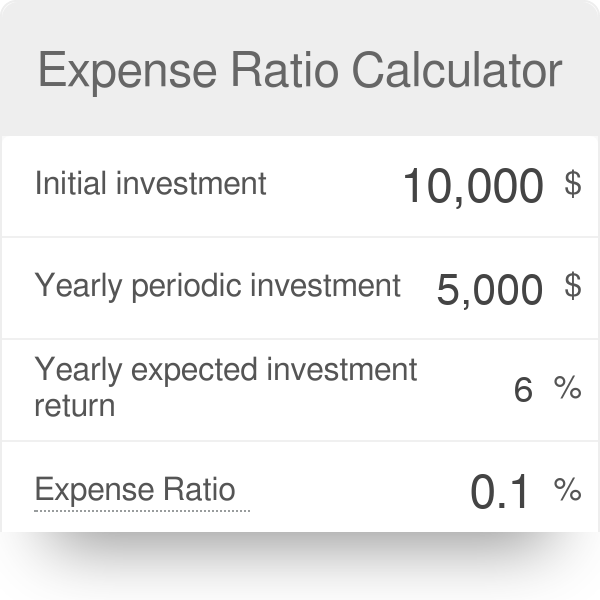

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Are Fidelity S Zero Expense Ratio Funds For Real Fund Investing Stock Market Index

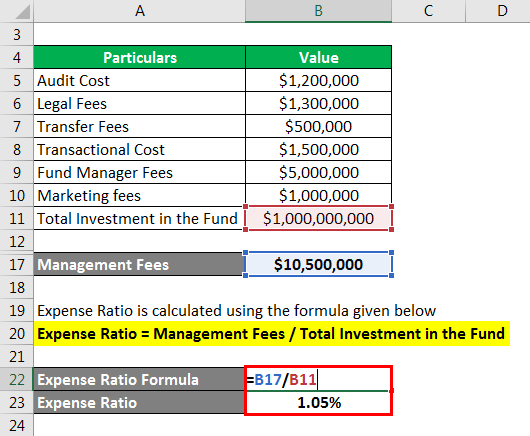

Expense Ratio Formula Calculator Example With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Zero Expense Ratio Etfs Have Arrived But May Carry Other Relevant Costs

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Formula Calculator Example With Excel Template

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

What Is An Expense Ratio Part 1 Wealth Meta

What Is An Expense Ratio

Actively Esg Etf Com Financial Advisors Segmentation Disease Prevention

Expense Ratio Calculator For Etfs And Mutual Funds Begin To Invest

Swtsx Vs Swppx Which Schwab Index Fund Is Best In 2022 Stock Market Index Stock Market S P 500 Index

Expense Ratio Formula And Fund Calculation Example

Expense Ratio Calculator For Etfs

Total Expense Ratio Formula Ter Calculator With Excel Template